Contribiia

Creating the MVP of a fintech app for collaborative savings and financial inclusion

Product Design

Mobile App

Nov. 2024 - Feb. 2025

BACKGROUND

Our team partnered with a Toronto-based fintech startup to design the MVP for Contribiia, a collaborative savings and credit building platform. Its mission: to foster financial inclusion and collaboration by digitizing informal community savings models—such as ROSCA, esusu, and pardna—that have been practiced worldwide under various names for generations.

ROLE

Product Designer (1 of 3) reporting to stakeholders: CEO and Co-Founder

Skillset: Product Design, User Research, Branding, Prototyping, Content Design

PROBLEM

Lack of reliable community fintech solutions

While digital banking is on the rise, many people still rely on informal savings practices like ROSCAs, esusu, and pardna, which lack the security, transparency, and scalability of modern solutions. Although effective in fostering trust and communal growth, these methods are hindered by security issues, unreliable members, and manual tracking.

SOLUTION

Merging tradition with fintech

By bridging the gap between traditional communal savings practices and modern fintech, Contribiia empowers users to save collaboratively while ensuring accountability, security, and ease of use. This app fosters financial inclusion by providing a trusted space for users to pool resources and build and track their credit all within a framework that’s accessible and user-friendly.

IMPACT

Putting business goals to the test

The MVP provided a solid foundation that brought business goals and concepts to reality, bridging complex challenges and moving the vision forward. Through user research and usability testing, we uncovered valuable insights that not only clarified the product direction but also revealed opportunities for new product directions.

Our team achieved over 90% task completion with the product’s core functionality. Additionally, as a result of our collaboration, Contribiia significantly evolved their MVP product by introducing impactful features like credit building and accessible loans, creating a lower-barrier pathway to financial wellness and better aligning with market demand.

Understanding the problem

Before starting the research, our team held a kickoff meeting with the client to discuss the project scope and understand Contribiia’s goals. Founder Shakir shared his vision of creating a platform that automates group savings to promote financial security and growth. While the product vision was already defined, we agreed to conduct research to validate assumptions and identify key user needs for this group savings product.

Establishing goals & KPIs

The goal of our research was to uncover actionable insights about Contribiia’s target users, focusing on their financial behaviors, trust-related concerns, and feature expectations.

To guide our progress and measure success, we defined key performance indicators (KPIs) at the outset focused on usability and trust:

Task Flow Efficiency: At least 80% of users should be able to complete key actions within 3 minutes.

Trust Validation: A minimum of 60% of users should find the platform’s trust-building elements—such as transparency cues and community-based verification—credible and reassuring.

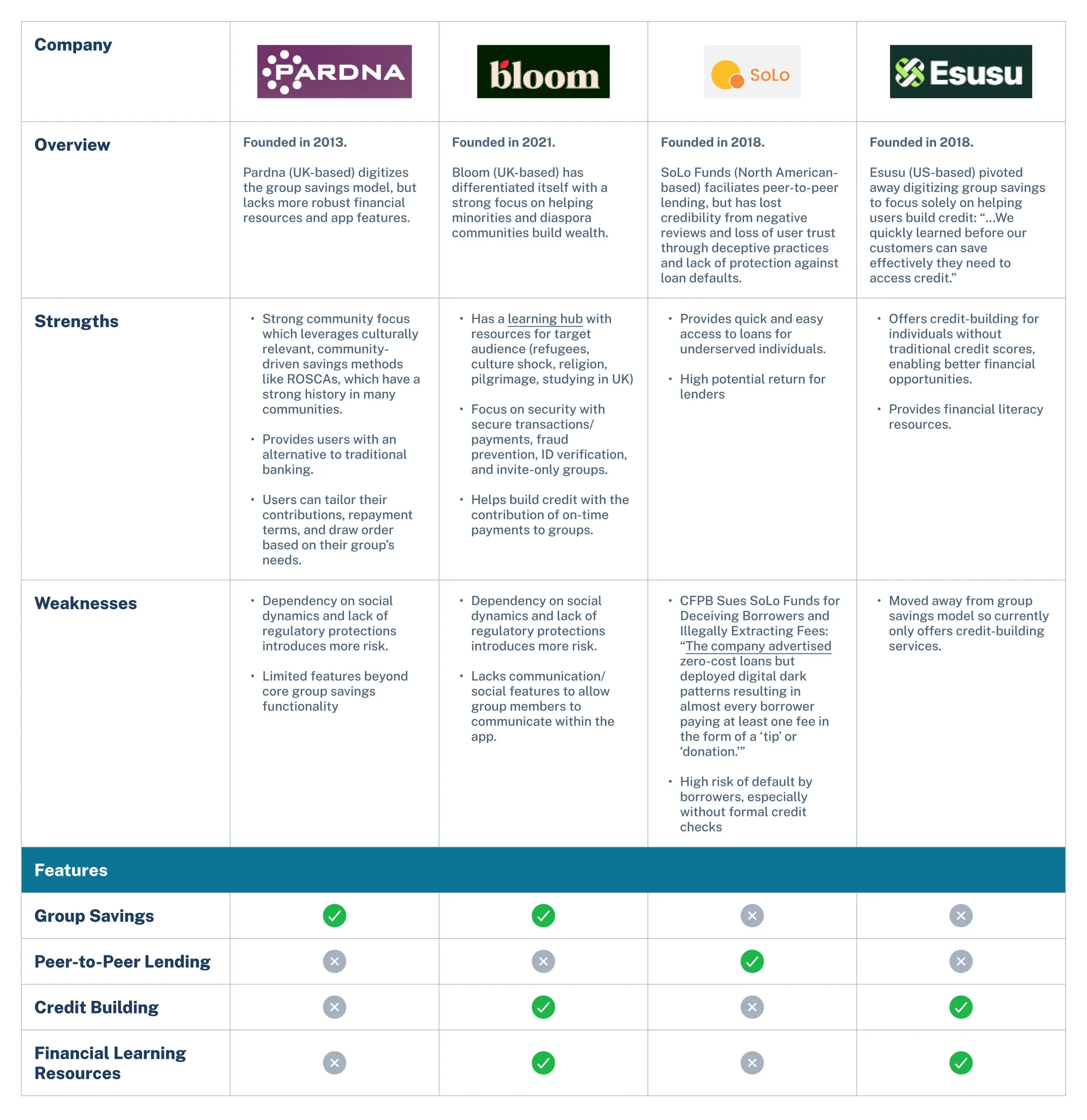

Competitive analysis

Our team started by conducting a comprehensive competitive analysis, looking at both direct and indirect competitors in the community finance landscape. This helped us gain valuable insights into opportunities within the fintech market, with a particular focus on solutions leveraging community-driven savings and lending models.

Findings:

Value Proposition: Competitors set themselves apart by offering educational resources and partnerships, such as credit-building, to provide a more comprehensive financial wellness experience and value proposition to users.

Target Audiences: Many existing platforms cater to regions like Africa and Latin America, where group savings is already culturally ingrained. These platforms aim to simplify the process for users already familiar with the concept. Additionally, some solutions focus on diaspora communities, addressing the lack of access to traditional credit systems for individuals living abroad.

Market Gap: Our research identified a gap in the North American market, where traditional financial institutions cater to structured products, but overlook the growing demand for alternative, community-driven financial solutions. This presents an opportunity to meet the needs of individuals seeking more collaborative and flexible savings models.

Based on this analysis, Contribiia had an opportunity to stand out by offering something unique to the North American market: a platform that combined the trust and transparency of traditional group savings with modern financial tools like credit score building.

Interviews

Our team conducted seven 30-minute remote interviews with potential users within the target demographic in the US and Canada to understand their needs for a group savings tool. We spoke to both individuals familiar and unfamiliar with group savings.

In the interviews, we asked participants about:

Their savings habits and goals

Current saving methods, challenges, and preferred tools

Perceptions and needs around saving collaboratively

Trust-building factors for financial platforms

We synthesized the results with an affinity map. The results validated our assumptions around potential barriers to adoption. Many people we talked to had never heard of group savings or found the concept confusing. Others were hesitant to trust strangers with their money. However, we found consensus across users needing a solution that was simple, secure, and transparent, empowering users to feel in control of their finances.

The following key insights emerged:

Trust is critical for user adoption. Users need a clear understanding of the benefits of group savings and how it aligns with their financial and savings goals. Trust in other participants' financial responsibility and transparency into group activity, like real-time tracking and contribution confirmations, are crucial for users to feel comfortable participating.

User empowerment and control is key to success. Users want the ability to make informed choices about who they collaborate with, with visibility into others’ timely payment history and financial stability to ensure confidence in group members.

Security was essential. Users expressed concerns over financial security and flexibility within the group savings model, revealing that adherence to fintech regulations, verified profiles, and safeguards against defaults were critical.

Persona

From this research, we created our user persona Jamie to guide our design process. Jamie is motivated to build better financial habits, but Jamie often finds group saving stressful—keeping track of who’s paid, sending reminders, and staying on top of progress feels like a second job. Past experiences with informal arrangements have led to trust issues and financial miscommunications, so Jamie’s looking for something more structured and transparent.

Defining the product

After reviewing the user research, we found that while group savings had potential, trust and security concerns were major barriers to adoption. Based on these insights, we worked with the client to reassess the product’s value proposition, ensuring it addressed users’ core needs and focused on the most important features for the MVP.

Reassessing the product direction

Presenting the client with our research findings, we began to explore ways to support users in improving their overall financial health. Many users expressed a desire to save for life goals, avoid taking on debt and high-interest loans, and to build credit to unlock better financial opportunities. Although the client wanted to retain the group savings approach, they proposed expanding the platform to incorporate credit-building and loan features.

With a new direction in clearer focus, we defined the problem statement to guide ideation and MVP development:

How might we build trust in group financial collaborations through increased transparency and accountability?

Defining & prioritizing the MVP

To accommodate the added scope of including credit building in the MVP, we collaborated closely with the client to redefine the MVP’s core functionality. Together, we identified and prioritized the most critical user flows that represent Contribiia’s unique value proposition. These flows were selected based on their role in enabling a cohesive and usable first version of the product, while ensuring a foundation for future scalability. The finalized MVP includes:

Onboarding – to ensure a smooth introduction for new users

Account Registration & Sign Up – to support secure and accessible access

Group Creation & Management – the social and functional backbone of the app

Credit Building – a key differentiator with measurable financial impact

User Profiles – to personalize the experience and support trust within groups

Portion of prioritized product roadmap (must-have features)

Designing the Solution

Information Architecture

The sitemap creation process began with mapping out core user flows, features, and content areas—such as account management, support, group functionality, and credit-building tools. Initial drafts revealed redundancies and unnecessary complexity in navigation. Through several iterations, the sitemap was streamlined to eliminate overlap, reduce cognitive load, and prioritize high-frequency tasks.

User Flows

I led the development of user flows for two critical actions—creating and joining a group. These flows clarified the user journey, aligned the design team on core functionality, and helped identify edge cases early, improving overall UX and reducing rework during implementation.

Wireframes

Beginning in low-fidelity, our team began designing, going through several iterations and rounds of feedback with the client to develop Contribiia’s key screens.

Our goal was to create an MVP that not only prioritized accessibility, trust, and ease of use but also provided a seamless, intuitive experience for every user. To achieve this, we developed detailed wireflows to map out user choices and app interactions, ensuring smooth navigation and clear decision-making at every step. We mapped out experiences for new users as well as existing.

Onboarding Tutorial: Simplifying the Complex

From user research, we knew that many users would be unfamiliar with group savings, so designing an intuitive onboarding process that clearly explained the app’s purpose, benefits, and functionality was key.

Sign Up: Building Trust

As one of the first touchpoints with users, we knew the sign up process needed to be secure and simple. As part of the account set up. users needed to verify their identity and link a bank account. Given this, we wanted the user to feel in control of the experience with options to skip and complete later as well as provide clear progress and security indicators.

Group Creation & Management: Prioritizing Ease

For group creation and management, we wanted to prioritize making the process easy and transparent. What began as a single form in our first iteration evolved into a guided flow to reduce overwhelm. We also explored multiple ways to display group activity, balancing transparency with avoiding information overload. Additionally, we explored features that could allow for more user control, such as chat features and managing payout orders.

Credit-Building: Empowering Users

We wanted credit building to be a key feature of the app and feel cohesive with other parts of the app. To that end, we aimed to keep the sign up process secure and simple and to enable users to view data about their credit score easily.

User Profiles: Fostering Transparency

To address users’ concerns about trust, we introduced a User Trust Score—a rating system based on on-time payments and user reviews. This feature gave users visibility into group members’ reliability, helping them feel more confident about who they were saving with.

In collaboration with the client, we defined the app’s visual identity, including the color palette, typography, and logo, to create a cohesive experience that aligned with Contribiia’s mission. The goal was to make the app feel modern, trustworthy, and approachable.

Branding

Logo

We presented the client with several logo and typeface options. The logo they chose echoed the product’s mission for growth through collaboration. As a way to further differentiate their branding, they additionally asked us to add “The Savings Club” as a sub header.

Color Palette & Typography

We selected a color palette of dark teals and blue-greens to evoke trust and calm, accented with vibrant pops of orange to introduce energy and draw attention to key actions. To ensure accessibility, we tested all color combinations for sufficient contrast, meeting or exceeding WCAG AA standards for readability.

For typography, we used Open Sans for headings and body text, paired with Inter for labels and buttons. Both typefaces were chosen for their high legibility across sizes and screen types, supporting an inclusive and user-friendly experience.

Validating the designs

Mid-fidelity usability testing

Our first round of usability testing with the mid-fidelity wireframes was illuminating. Users were very positive about the credit-building features, but still struggled with the concept of group savings and desired more support and transparency. Based on our mid-fidelity user tests, we identified a few key areas for improvement to prioritize in the next iteration:

Onboarding: Simplify the language, interactions, and explore visuals to better explain core concepts.

Sign Up: Build trust by clearly adding security indicators and explaining data protection during sign-up.

Group Features: Improve visibility of key group details, progress, and actions.

Credit Building: Make credit score tracking more actionable by adding resources to help users interpret and improve their score.

High-fidelity designs

Having a better understanding of what resonated with users and what could be improved, we progressed to high-fidelity wireframes. This phase allowed us to refine the visual details, interactions, and overall user experience from the test results, bringing the app closer to its final form. At this stage, our team developed a comprehensive design system to ensure consistency and cohesiveness across all screens, streamlining the user experience and maintaining visual uniformity throughout the project.

Onboarding

Group Functionality

Credit Building

Key Iterations

We put our high-fidelity designs to the test again. The feedback was encouraging—users found the core functionalities intuitive and valuable. They appreciated the flexibility in group settings and the added benefit of credit score building.

But there were also areas for improvement. Some users found the onboarding process a bit overwhelming, and others felt the UI could be more visually engaging. We took this feedback seriously and made adjustments to improve clarity, trust, and visual appeal.

Enhance Visual Appeal & Clarity

We iterated on the dashboard and group pages to improve the visual appeal and usability, reducing cognitive load and enabling users to easily track progress and key dates.

80% of users misinterpreted the duration tracker as a savings progress indicator and struggled to scan key group information. I redesigned the group info card with a cleaner layout, removing confusing visuals and consolidating the space for better usability.

60% of users felt overwhelmed by the circle graphic when seeking group progress information. I redesigned the group page to reduce cognitive load by prioritizing key details like status and upcoming dates while moving common actions like chat higher on the page.

Increase Transparency

Customization options when setting up a group were well-received, but we need to improve wording around contribution amounts, insurance, and fees to ensure users feel fully informed.

We also further broke down the flow, offering detailed explanations about each setting and real-time feedback based on user inputs, so they could easily understand how their choices influenced group settings and savings goals.

60% of users—particularly those new to group savings—reported feeling overwhelmed during the group creation process. Many expressed a need for clearer guidance on configuring group settings and setting up their groups effectively.

In the next iteration, we split group settings into separate screens with contextual help text to reduce cognitive load and help users focus on one task at a time. Progressive disclosure reveals relevant details at each step, keeping users focused and helping them understand the impact of their choices.

Client handoff

We were excited to hand off the MVP designs to the client, including a fully functional prototype and UI kit. The prototype offers an interactive experience, allowing the client to visualize the core features and functionality in action. Along with the prototype, the UI kit provides a set of reusable design components, ensuring consistency and ease of future development.

Impact: A Strong Foundation

The final MVP prototype was well-received by the client, successfully addressing core user needs and setting a strong foundation for future development. We delivered a high-fidelity prototype that offered both functional clarity and a cohesive design direction—backed by foundational user research to inform next steps.

Against our key performance indicators:

Task Flow Efficiency: We exceeded expectations, with 90% of users completing key actions within three minutes, surpassing our 80% target. This validated the clarity and usability of our core workflows.

Trust Validation: While the platform’s transparency cues and community-verification features showed promise, only 48% of users rated them as credible and reassuring—falling short of our 60% benchmark. This highlighted the need for deeper iteration on trust-building elements, such as clearer language around verification, more visible social proof, and improved onboarding context.

While the MVP was a critical milestone, it also surfaced clear opportunities for growth. Next steps include refining trust signals, expanding community features, and introducing new content patterns to better communicate platform intent and safety. These improvements will not only enhance credibility but help further define and differentiate Contribiia in a competitive landscape.

Takeaways

Challenges & Lessons Learned

During the course of the project, user research and testing revealed that the initial product concept did not fully resonate with users and faced challenges aligning with market demand. Within the time constraints, we collaborated closely with the client to refine the product’s functionality and design, incorporating these insights to better meet user and business needs. Given more time, we would have advocated for a more iterative approach, exploring alternative solutions and conducting further research before moving into prototyping.

Recommended Next Steps

Continue refining the product direction and target users with additional market and user research.

Enhance onboarding clarity and cultivate trust, including adding app previews and onboarding tutorials.

Continue to test and iterate on the data visualization on the dashboard and group pages to make them more engaging and useful.

Explore new features to further differentiate Contribiia in the market and boost user trust and engagement.